Investment track record

121-159 Station Road East, Oxted, Surrey

ON THE MARKET: prime freehold mixed-use investment anchored by Waitrose in one of London’s affluent commuter towns. Get in touch for more details.

Greyhound House, 23-24 George Street, Richmond

ON THE MARKET: prime freehold mixed-use investment in one of London’s wealthiest suburbs. Get in touch for more details.

Regent Square House Royal Leamington Spa

ON THE MARKET – Landmark freehold reversionary mixed-use property in the heart of ‘Silicon Spa’s’ gaming cluster. Get in touch for more details.

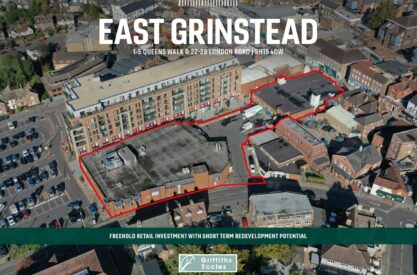

Queens Walk & London Road, East Grinstead

UNDER OFFER: Freehold retail investment with short term redevelopment potential. Get in touch for more details.

Acorn Portfolio

A prime mixed-use portfolio of 5 assets. 69% of income secured for over 10 years and subject to index linked rent reviews. Portfolio WAULT 13.7 years. Griffiths Eccles successfully sold the assets for clients of CBRE Investment Management.

28 Chase Road, Park Royal, London

ON THE MARKET – Freehold short-term sale and leaseback of a 21,500 sq ft industrial unit in the heart of Park Royal. Get in touch for more details.

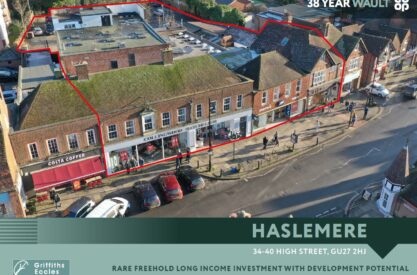

34-40 High Street, Haslemere

A rare freehold long income investment with future potential redevelopment potential. WAULT of 38 years. 79% of income secured to Co-Op for 48 years. Griffiths Eccles successfully sold the asset for clients of CBRE Investment Management.

Sainsbury’s, Chipping Norton, Oxfordshire

A prime freehold Sainsbury’s extending to 15,000 sq ft in the centre of the beautiful Cotswold town of Chipping Norton. Griffiths Eccles acquired this asset for a private investor.

99-101 London Road, Croydon, London

A Lidl supermarket for a further 26 years within index link reviews with local government offices above, on a Greater London site of 2.77 acres with future redevelopment potential. Griffiths Eccles acquired the asset for a family property company.